Eligible BECU people you desire only to build down money of just one%, and you can BECU will pay the rest

Jumbo fund as a consequence of BECU are provided just like the each other fixed- and you can changeable-rate funds and you may manage borrowers the capability to funds land one to be expensive than simply a conventional buy.

The new Government Homes Funds Service kits minimal jumbo amount borrowed on $453,one hundred, regardless of if this may be slightly higher in a few states having foot costly home costs. People in search of large-really worth properties can opt for an effective fifteen- otherwise 31-12 months fixed jumbo loan or 5/5, 5/step one, step one0/step 1, or 7/1 Hands.

Given that label means, that it loan is actually geared toward first-day homeowners and you will, from Earliest-day Family Buyer Grant Program, financing would be repaired, antique or 5/5 Arm.

Some other $6,five-hundred tends to be granted from the BECU to assist financing an all the way down fee, and individuals make the most of without to pay origination charge. The style of this loan causes it to be best for more youthful consumers incapable of afford initial off costs, who will benefit specifically away from additional agent support.

BECU Va financing

Virtual assistant fund bring certified pros, reservists, active-obligations servicemen and you can girls, and you will eligible household members having resource when it comes to repaired- or variable-rates mortgages having reasonable or no down payment possibilities.

Individual mortgage insurance is not necessary, and you will settlement costs and costs are limited. Pros can use their Virtual assistant Certificate out of Eligibility (COE) owing to good BECU Virtual assistant mortgage, and versatile credit certification guidelines enable it to be easier for consumers that have suboptimal credit scores.

BECU framework money

Borrowers building homes by themselves may benefit out of BECU’s interest-only conditions during the construction phase. Since residence is finished, financial terms convert to a long-term home loan without the need to document most papers otherwise spend additional fees.

Consumers whom hire elite group builders may use BECU’s Leased Builder program, wherein mortgages may be made to account fully for doing 80% out-of mortgage-to-order will set you back, or the appraised worth of the fresh to help you-be-based home.

BECU HELOC

Household collateral line of credit (HELOC) financing enable consumers to gain access to and you may power the present collateral inside the their houses for several financial obligations for example combining personal debt, to make a life threatening home improvement, or to acquire almost every other sizable assets. By way of BECU, HELOCs are offered and no costs to have origination, assessment, term insurance rates, pre-payment penalty, escrow, and document mailing.

Tailored given that an unbarred-end mortgage, property owners can always borrow against the equity as they wade, as opposed to taking out one share initial. Having credit partnership members who’re uncertain exactly what its eventual venture will cost you tends to be otherwise who’ve multiple property that require funding, good HELOC are better.

BECU Mortgage Customer Sense

BECU now offers a number of easy-to-see member resources during the their webpages. Together with mortgage calculators, a native Inquire a question search pub, and you will helpful blog site content seriously interested in all of their number 1 properties, the fresh new monetary institution’s BECU & You webpage is full of interactive tips instance infographics, webinars, self-paced courses, and you can academic books. Parents can also use these to activate their children that have economic-literacy information.

BECU as well as conveniently provides methods that to get in touch with monetary advisors inside the a more personalized form. Among those programs is the free Monetary Health check, which is a single-on-that, real-day appointment with an expert exactly who assists users do so to the budgeting, offers, spending, and debt government. Appointments generally last anywhere between forty-50 times.

Free class presentations are also available to West Arizona owners and you may are provided by the BECU financial educators. Categories will be customized so you can high-school, university, or adult visitors, with subject areas between risk administration and borrowing from the bank to help you cost management and you will first-time homeownership.

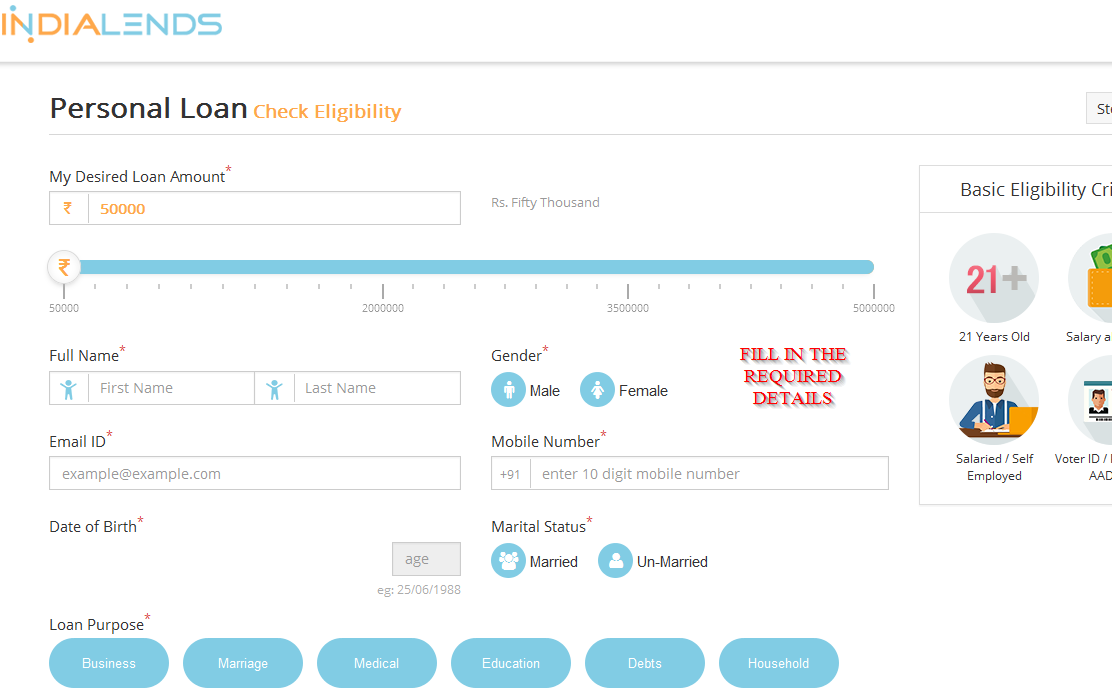

Such associate-centric properties fit user friendly conference-booking have and simple on line apps. Individuals making an application for mortgage brokers on line have to indication E-concur forms and become available to the method for taking about 20 minutes or availableloan.net/installment-loans-la/hammond/ so. A sample checklist regarding products needed to apply on the internet were: