How to prevent Defaulting towards the an unsecured loan

You may need to operate rapidly to quit shed an installment and you may defaulting for the a consumer loan. According to the condition, you might check out an approach to eradicate other expenses, re-finance your debt or get assistance from the financial otherwise a good borrowing therapist.

On this page:

- Whenever Try a personal loan in Standard?

- Steer clear of Defaulting to your a personal loan

- Do you know the Consequences regarding Not Paying down Your loan?

If you’re struggling to afford your own costs and you can consider you could miss your upcoming unsecured loan payment, you really need to evaluate the choices in advance of it’s too late. Losing at the rear of and in the end defaulting on the financing can lead to extra fees and you can harm your own borrowing from the bank consistently. You are capable of getting help otherwise avoid the later percentage for people who act easily.

Whenever Try a personal loan from inside the Default?

The loan can get theoretically enter default when you initially miss an installment, since you will be failing woefully to followup into terms of brand new mortgage contract you signed. However, of numerous signature loans (and other user fund) has an elegance several months in advance of a cost are reported into the credit agencies because late.

Despite the elegance months has gone by, loan providers get consider carefully your financing outstanding to have an occasion prior to declaring they within the default. How long the loan is considered unpaid depends on the lender, however, always immediately following three to six weeks, it could be noticed inside default.

Steer clear of Defaulting on a personal bank loan

You will find some suggests you may be able to stop shed your own mortgage fee, but the ultimate way varies according to your situation.

Like, if you fail to manage an expenses this few days because of a great one-time setback, dipping towards the an urgent situation financing or briefly depending on a cards credit might make feel. But if you have a much difficulties to have days in the future, you may also keep your disaster funds for crucial expenses (such as construction and you will restaurants) and believe other available choices otherwise types of direction.

Opinion Your finances and you may Cut back

If you possibly could slashed costs, you may be able to free up currency you might place for the the loan repayments. Remark your financial allowance otherwise previous financial and bank card comments to rating a feeling of how much cash you happen to be expenses and you will where your cash is supposed. When you are cutting back has never been enjoyable, avoiding a late payment will save you currency, and you will maintaining your good credit can provide you with more economic choice subsequently.

Contact your Bank

When there’s no push space in your budget otherwise you will be coping that have a crisis disease, such as for example a missing out on work otherwise unforeseen medical debts, contact their bank instantly. The business s, particularly a temporarily lower rate of interest otherwise monthly payment, otherwise a temporary stop on the money.

Refinance otherwise Consolidate the borrowed funds

When you installment loans in Bakersfield VT with bad credit have good credit, it is possible to qualify for yet another mortgage you can utilize to refinance otherwise combine expense. Your own monthly premiums you certainly will decrease should your new loan provides a good straight down interest or lengthened cost title. If you’re swinging loans from one bank to another isn’t a renewable long-identity strategy, it could give you sufficient respiration place to capture abreast of your bills and get away from defaulting in your loan.

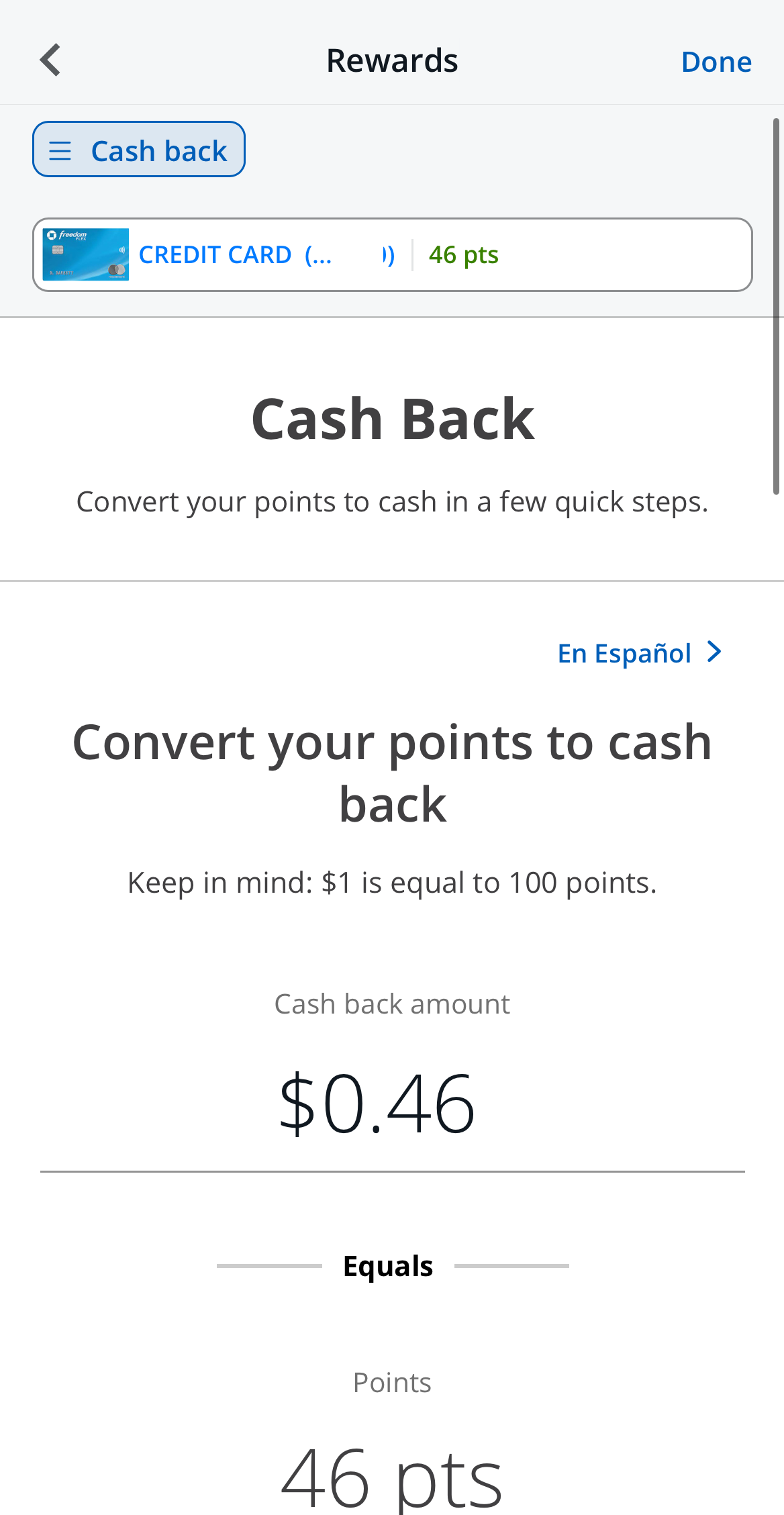

Fool around with an equilibrium Import Bank card

Like having fun with a different mortgage, particular playing cards bring a marketing 0% apr (APR) to your transfers of balance. A few notes also let you transfer a balance toward family savings, and next use the currency to blow off or off the personal bank loan. It may be simpler to make bank card repayments and you will lower your debt once the credit card is not accruing focus.