Good Credit history will save you A lot of money

Because the interest rates to the much time-term mortgage loans continue steadily to go up, to buy a home from the the present number-highest prices should be an issue. Yet not, a recent study off Zillow unearthed that you will find some thing home buyers is going to do to store themselves big time whether or not it comes to mortgages: boost their credit scores.

This really is you to actionable matter consumers will perform to save a bit of cash in so it anda Pendleton, consumer loans pro in the Zillow Mortgage brokers inside an interview that have CNBC.

Credit scores Is actually Big Hitters

It is because loan providers use fico scores in order to gauge exactly how almost certainly its that a debtor usually pay the newest financing. This is not truly the only grounds, however it does gamble a huge part when you look at the just deciding in the event that a purchaser will be eligible for a home loan, and also what kind of interest they shall be offered.

The fresh Zillow investigation reported that according to research by the average You.S. domestic speed today – $354,165 – home buyers with down credit scores pays as much as $103,626 also the category of a 30-year fixed home loan than a special buyer that have higher level borrowing from the bank.

That really works off to on $288 a whole lot more 1 month of these with reasonable credit ratings, otherwise people ranging from 620 and you will 639, than those which have score believed higher level, ranging from 760 and you may 850.

Therefore the huge difference arises from the range of interest rates those individuals individuals discovered. For example, when you find yourself anyone having advanced level borrowing has been offered a speeds of 5.099% in into the a 30-year repaired financial, a debtor with only reasonable credit will be billed 6.688% at this same day and age, based on Zillow’s studies.

The ingredients out-of a credit rating

Credit scores depend on four basic affairs. First and most influential is the commission records. Have you got good track record of using their costs timely? Per late fee have a tendency to ding your credit score.

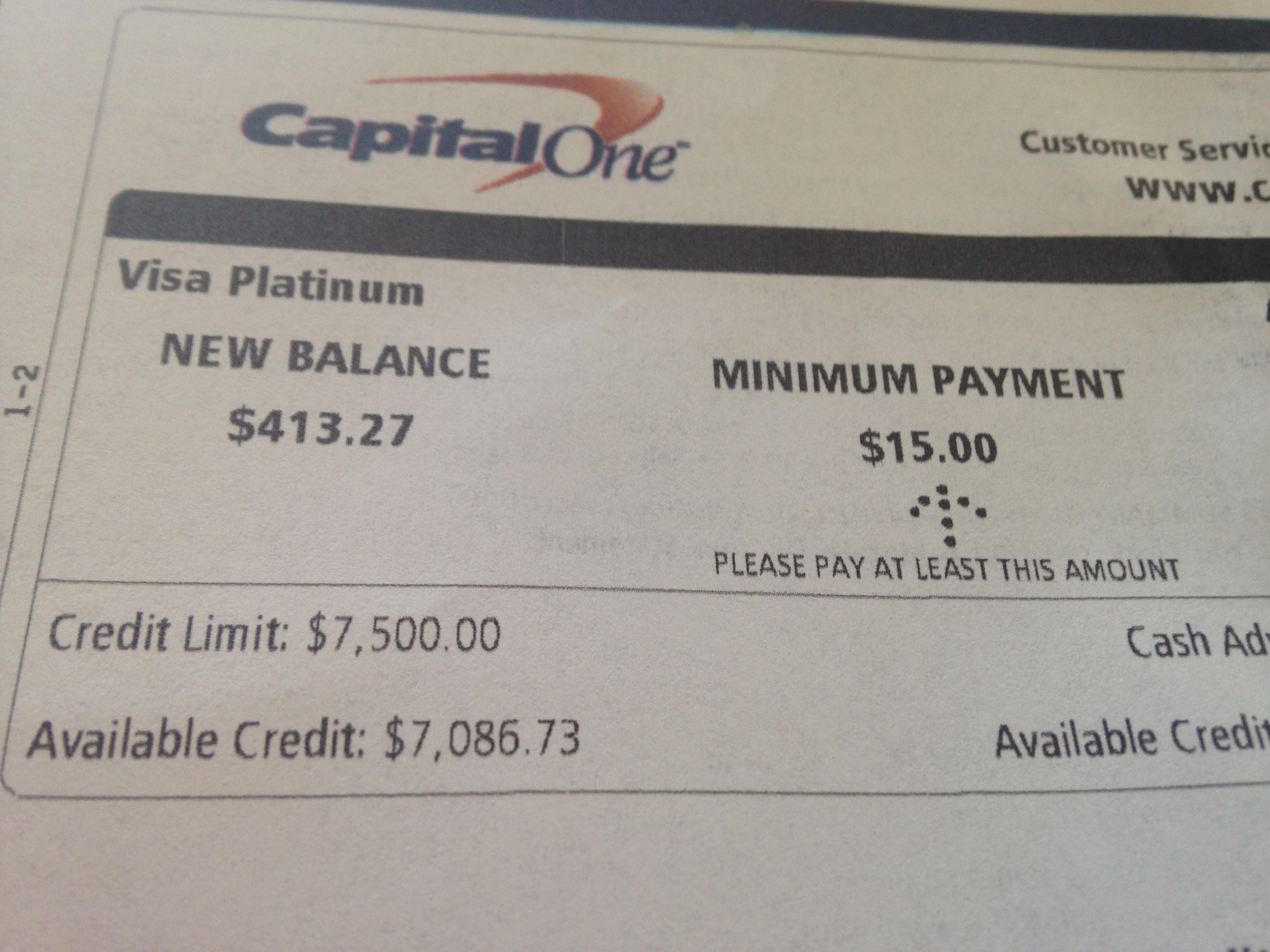

Another grounds is how far obligations you borrowed from in line with their offered borrowing from the bank. While you are maxing your bank card limits, it appears as though you’re into the a eager monetary state and a lot more vulnerable to falling at the rear of into the money.

Third, the length of your credit report support dictate the score. The fresh extended your time and effort using borrowing, the greater amount of study the credit bureaus want to get an accurate picture of the creditworthiness.

The fourth borrowing from the bank element is the variety of borrowing from the bank levels your availability. Fees finance eg vehicle and you will pupil obligations commonly push your score higher while using the loads of revolving financing particularly playing cards is down it.

Last but not least, the last factor is how far this new credit you have removed not too long ago. Any credit concerns stay on your report having anywhere between a dozen and you will eighteen months. If you’re always interested Delaware title loan in the fresh new personal lines of credit, it will appear to be you are not dealing with your finances better.

Boosting your Score

You could begin by the checking your credit score, that you’ll manage at no cost with each of the three big credit reporting bureaus. Begin by looking for one errors and aware the brand new bureaus quickly to fix them. This may render your score a quick boost.

If you’ve been destroyed repayments or losing behind, you can view a decent uptick on the get for folks who concentrate on purchasing that which you strictly promptly for another six days. If in case you can manage to lower your financial situation through the you to exact same time for you 30% otherwise a reduced amount of their credit limitations, you will look for a score improvement. And you may without a doubt refrain from applying for one brand new finance for a couple days prior to purchasing a property otherwise as the financial techniques begins. Hold off toward to invest in that new seats or the vehicles up until your loan shuts.

If you are enhancing your credit history takes some time, it can most repay in terms of saving money on your own next house pick.

Delight contact us today to see just what the payment was if you decided to get otherwise refinance your home.