Having non-customers, particular banking companies have a max 20-12 months name

Most mortgages is going to be put up which have regards to twenty five years (for low-residents) and 30 years (having customers), constantly to a max age 75.

Qualifying Criteria to own mortgage loans when you look at the The country of spain

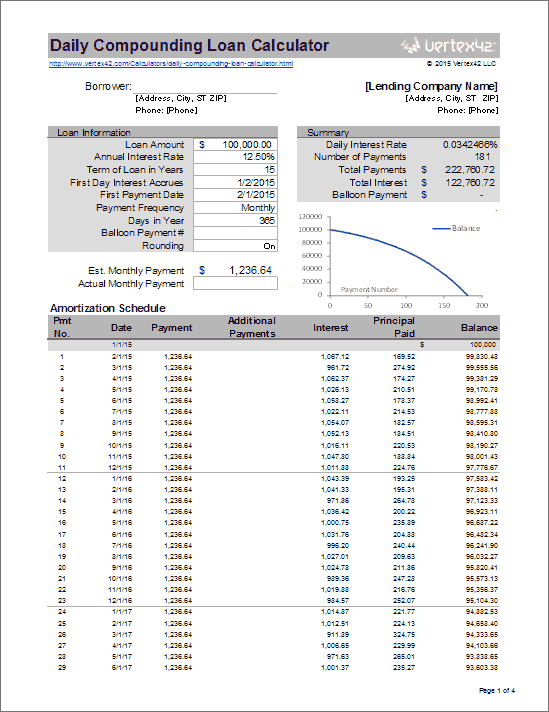

Lenders in the The country of spain all play with what exactly is called a debt-to-earnings calculation because reason for deciding if applicants tend to meet the requirements for a mortgage. In basic terms, thus your monthly obligations obligations, such as the the financial, should not surpass certain part of their web monthly money.

The typical commission try between 29-35%, very let me reveal an extremely earliest exemplory instance of the formula works well with an used https://paydayloansconnecticut.com/naugatuck/ applicant whose simply personal debt ‘s the cost home loan on their main quarters:

There are many different additional factors to consider, however, this gives an incredibly general idea regarding the banking institutions assess the candidates into home loan. Again, we strongly indicates handling united states at A put in the newest Sunrays Mortgage loans, even as we an out in-depth finding out how for every single lender work.

Software Techniques

- Initial, no obligation, testing – consult with A devote the sun’s rays Mortgage loans or finish the on the internet mode on this page and we’ll advise you towards the if or not home financing recognition is likely and you will just what criteria might possibly be you are able to.

- Financial offer following very first review, A put in sunlight Mortgages tend to aim to upload a beneficial complete home loan offer inside 24-a couple of days.

- Signup – if you want to go ahead, A devote the sunlight Mortgages usually ask you to indication this new small print and program percentage out of a charge away from 695, which comes having a money back guarantee, so if the loan is refused the fee when the refunded (susceptible to brand new small print). For very small financing, it will be easy on the best way to bypass the brand new representative charge and you may be lead so you can a lender physically. Please be aware, zero authoritative recommendations will be presented whether or not immediately following once you understand the profile, the most likely financial could be needed.

- Complete application form A put in the sun Mortgages will help you which have doing the appropriate application form and they will submit which in your part to your compatible help data files, which they commonly demand once you’ve agreed to go ahead that have the application form.

- Choice regarding bank if your home loan is eligible, A place in sunlight Mortgages have a tendency to show the standards and you will ask if you’d like to just do it. So it fee is actually payable into the initial approval of your own mortgage, in advance of valuation. The high quality matter try 0.6% of the financial number (minimum step one,000). To possess larger home loan wide variety which fee could be flexible. Brand new charges try getting basic financial/mortgage transactions but from inside the extremely certain instances, and specialist’ financing. We’re going to constantly help you on paper of payment size to get applied ahead of continuing having a credit card applicatoin.

- Establish checking account and teach valuation a checking account was created and you’ll be asked to put enough loans to cover valuation fee.

- Valuation report if for example the valuation isn’t any less than brand new consented cost and the assets does not have any legal issues, the completion plans can be produced.

- Completion plans An added the sunlight Mortgages work on the bank as well as your attorneys and they’re going to confirm the funds very important to achievement, and therefore must be directed as quickly as possible for your requirements towards the lender. While the financing come into new membership, the financial institution commonly get ready everything and you will opt for a beneficial end date at notary.

- Conclusion time the lending company tend to set up the called for cheques and you may plan payment of the home and you will home loan taxes from all of these loans. As the possessions and mortgage deeds was finalized, you feel who owns the house.