Determine Your way on Best interest Prices having Axis Financial Unsecured loan EMI Calculator

You may have intentions to remodel the kitchen, pick a new automobile or marry the following year. So why wait whenever you can benefit from the most readily useful short-term borrowing products up to? Personal loans could be the prime loan services to meet your needs in these cases. With a personal loan, you could finance any small-label economic requires of yours. From the christmas to planning a wedding, vacationing with household members, and you will and work out home improvements, money is the need of one’s hours. That’s why we want that know that you could make use of your Axis Financial 24?eight Personal bank loan and also make the goals come true without worrying concerning the refinance.

When you require cash urgently, your first avoid should be a personal bank loan. A personal loan away from Axis Bank also offers several advantages such as for instance an effective quick software process and control in 24 hours or less, flexible payment alternatives, the lowest interest, and much more. In addition, we also provide you done on the web confidentiality and you can an instant investment months which means that your mortgage could be approved within 24 hours, and funds would be placed into your savings account in this 72 times. You can submit an application for an unsecured loan out of as low as Rs.fifty,000/- to help you Rs.10 lakhs to your needs you need take a trip, renovations, etcetera.

However, something that new debtor should keep a check into before you apply is exactly what is the specific interest he or she is planning to spend for the reason that it yes could affect your financial budget after ward.

What’s the importance of Rates of interest for the Signature loans?

Rates of interest, what exactly do they mean? Do you know how your own interest impacts you? So it question you’ll arrive at the head whenever you are considered having a personal loan. Rates are very important becoming determined in because of the cost out of borrowing from the bank. The interest rate will tell you exactly how higher the price of borrowing are, otherwise higher brand new rewards is to own protecting.

When taking financing, let’s say particularly to own a personal bank loan from inside the India, you will be charged some interest rate. This matter is essentially a percentage of your own matter that you got just like the a loan. Mortgage loan is largely the expense of borrowing and/or savings you create. By now you’ll want realized the importance of rates on your consumer loan you should be thinking the way you may get it prior to even implementing, well you can simply do so by using an online EMI Calculator .

Why you should Determine Your Financing Interest rates

Your own Loan interest rate is amongst the key components from a personal bank loan. Whether you’re getting a personal loan the very first time otherwise refinancing so you’re able to a very useful price, finding out how your interest works are imperative to providing advantage of the many that your lender provides. The truth is, not all the mortgage brokers is actually equivalent. Some will get hold lower rates and therefore bring straight down month-to-month costs as compared to someone else which have high prices, to pay for significantly more requires than just you could which have a different lender when you yourself have currently determined a Mortgage. Using a personal bank loan calculator is not brain surgery and yet, people spend days figuring out where they could assess mortgage interest levels, where it get the best price, and that Consumer loan as long as they like, etcetera. I intend to make clear the private Mortgage interest rates calculator techniques by the suggesting the way to do it about safest possible way.

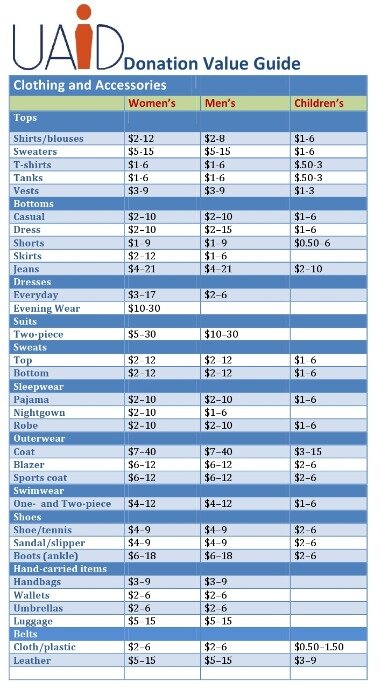

Personal loan EMI Calculator is actually a useful on line product that provide your having a concept precisely how the EMIs will be in instance you determine to use a consumer loan. Everything you need to manage try enter the called for details and you may the fresh device usually instantly calculate their EMI and have now exactly what amount it would be in order to patch your bank account most readily useful.

This new formula to have Financial EMI Calculation:

r: Rate of interest four weeks (the yearly interest was bad credit loan emergency split of the several to get the month-to-month rate of interest), and you can