The fresh new No-Nos When searching To try to get A mortgage

- Mortgage Articles

- Errors To quit Before you apply For Mortgage

You know what you are designed to do before taking loans online Minnesota a step into the applying for a mortgage check out the home prices, save getting in initial deposit. The things do not be performing, but not, was scarcely discussed.

You can alter your chances of getting the household you need by avoiding brand new problems that may reduce the amount of money you could see, improve the interest rate on the financial, otherwise lead a lender so you’re able to refute your application.

We’re going to allow you to in the on the half dozen big problems all of our Experts say you need to abstain from when you are going to get a mortgage.

Changing Work

A lender should be in hopes you have a stable earnings and you can sustain to pay for home financing fees expenses monthly. Thanks to this at the very least 24 months of constant a job considerably improves their financial application. Additionally, your chances of qualifying for a home loan was compromised when you button work ahead of using. Of everything don’t be doing ahead of getting ready your mortgage software, modifying perform was near the top of the list.

Skipping Costs Payments

Your fee history usually makes up thirty-five% of your own overall credit score. It indicates even you to definitely later commission is enough to take your get off by fifty products or even more adequate to charge you your house you prefer.

Lenders seriously consider the credit an incredible number of applicants. Work at improving your score and you will maintaining they before applying for the loan.

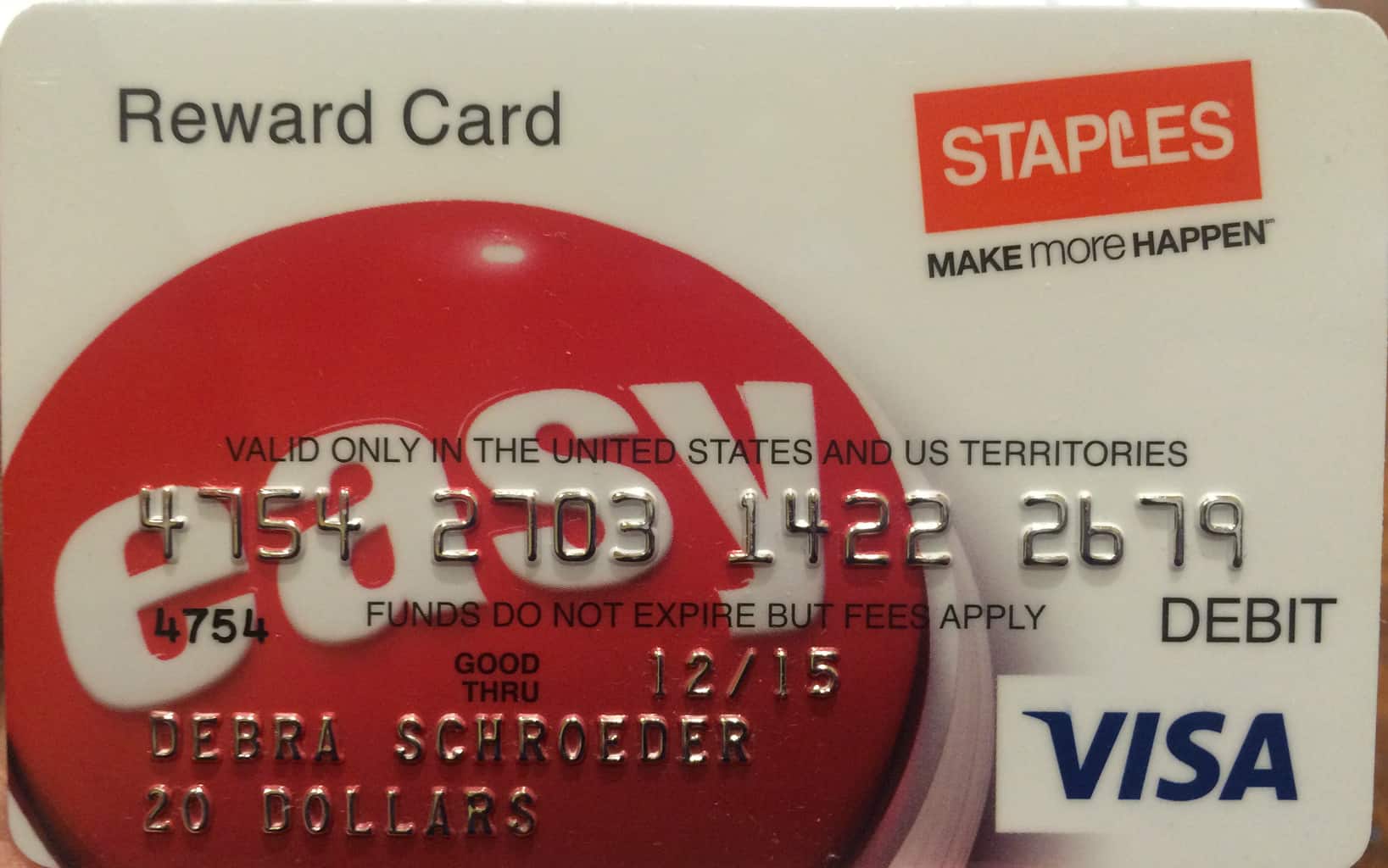

And then make Biggest Instructions

To buy a car or truck, a refrigerator or people major goods isn’t the most useful disperse before applying to possess home financing. With genuine coupons is one of the earliest some thing lenders need out-of borrowers and and come up with a major buy can cut in the money on hands. Taking out fully that loan otherwise making use of your charge card and then make a purchase are an even bigger warning sign so you can a lender.

Stacking Right up Bills

Taking on numerous expenses before you apply to own a home loan have a tendency to boost your loans-to-earnings ratio, which is your overall obligations, for instance the potential mortgage, split up of the just how much you earn a year. The better this new DTI, the low your chances of a loan provider granting the loan.

If you have good DTI away from six or more total obligations at the least half a dozen moments your yearly income lenders often consider you a dangerous debtor.

Shutting Off A credit card Membership

In a lot of circumstances, closing a cards-card membership is actually an intelligent disperse but not when you need to apply for a home loan.

If you get rid of a credit card, the amount of available borrowing from the bank are faster. This may damage your credit rating, as your debt-to-borrowing from the bank proportion you will increase. Especially if you has a big credit debt, closure the newest account will not let your credit rating however, have a tendency to carry it off as an alternative.

Agreeing In order to Co-Sign on A loan

When you co-sign, you commit to be partly guilty of the debt the fresh new debtor is liable to invest. It means a big damage on your credit score once they don’t generate those costs on time.

Any time you Follow You to Financial While considering Obtaining A Financial?

You might think easier to adhere one to bank and you may browse what they favor and you may what they try not to. However, this should limit one one lender’s procedures.

Rather, go through various other lenders’ formula, research your options, get the best interest rate possible and make certain to pick the deal that suits their financial need a knowledgeable.

Here’s where an expert large financial company comes in helpful. Financial Advantages provides fifty+ loan providers in its committee, that you’ll peruse before applying.

Your agent will ensure you pertain toward bank in which you have the best opportunity at winning acceptance for your house financing.

In the event that you Get Pre-Recognition First?

If you are planning so you’re able to winnings your ideal assets in the a keen auction, you need to submit an application for pre-approval on the that loan earliest.

What’s the Approval Techniques With Home loan Advantages For example?

- Complete and signal all of our brief form.

- Render evidence of your earnings, discounts, and you may costs, such as playing cards or other funds.

- We will done a preliminary testing and recommend several suitable loan providers and you may fund.

- We’ll hotel the application to your lender you’ve selected.

- The financial institution have a tendency to done a review of the disease and gives pre-acceptance.

Regarding hotels your pre-recognition software so you’re able to assisting you get the best rates, Home loan Professionals will do it-all. Read our detailed webpage toward home loan pre-acceptance for lots more expertise about how precisely the procedure is other during COVID-19 restrictions.

Communicate with A professional

Financial Experts helps you opt for the correct loan solution and you will check your residence financing disease for the best you’ll be able to result. Contact us to your 1300 889 743 otherwise fill in the online enquiry form.