Thus what is going to make sure they are go quite high in order to 150, 175 percent regarding financing-to-worthy of rates?

It’ll be a bona fide problem in their eyes. And so i definitely – all of us, Susan, anyone wishes us to bring that it construction problem and therefore foreclosure condition by throat and eliminate they, because it is destroying the newest economy. However, if we do not provides often dominating write-lows, do not have the option of bankruptcy proceeding, in which people can protect their houses, do not have just what FDR performed when house damaged to have his people and he lay a beneficial moratorium to the foreclosures immediately after which written an organization to re-finance such fund and also make these financing – we don’t have of the.

It’s just all of the voluntary, let’s all interact and you can guarantee you to definitely, once we would these types of incremental tips, it’s going to make an improvement.

In case your mortgage-to-worthy of proportion in your home are 125 per cent, they’ve been saying that it does rise to help you 150

And you will, as Judy mentioned – as the Susan pointed out, i’ve a beneficial monumental activity before you. Therefore we you desire things bigger than these types of progressive strategies.

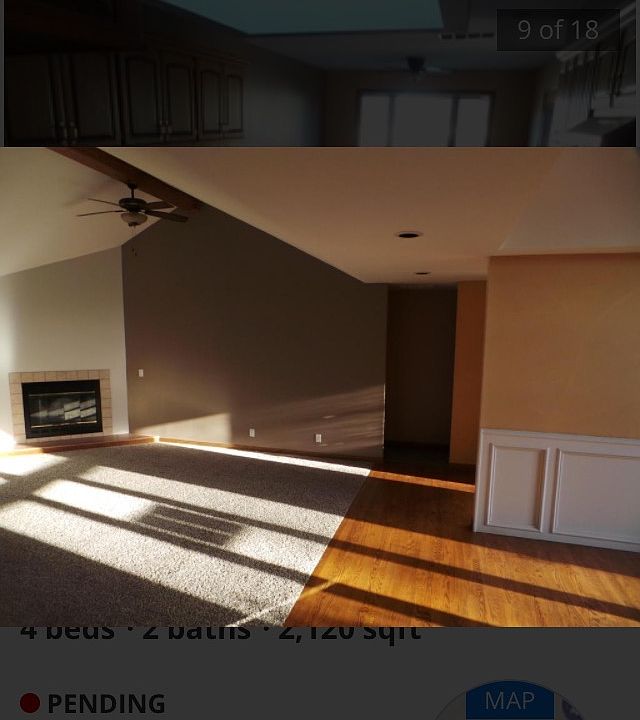

Nonetheless, this will be an optimistic action. This is certainly win-earn. And it is just – you are aware, one to $70,000 house that individuals read away from Jon, that would be considered, one house, but not under water, for as long as consumers try newest, with this short exception of one’s a month.

And people someone must have this option, so that they today will have this 1. You need to? This is certainly something which are, is readily available. And you will, and, you’ll find details from the plan which are quite unknown. Thus I am not sure just how it will likewise come out. But, nevertheless, the information are that more of those commonly close than before.

So, actually within 125, that’s the most recent height, they have not been to make these kind of modifications or such refinances for even funds to 125 per cent

Brand new fees will additionally be less you to Fannie and you will Freddie possess been battery charging. And therefore could be a casino game-changer including…

Susan – Susan, only quickly, exactly what – of course specific element of so it functions, think about the greater property image? What exactly are i kept with even as we look at the second 12 months?

The issue is, in the event that property prices start to refuse once again, then we possibly may enter a vicious cycle, the new housing marketplace weakens, and you may ultimately causing the overall discount weakening, resulting in the brand new housing market. We want rate balance. Which have rates of interest within historic lows, we are able to reach rate stability. The main try employment increases.

Well, offered i’ve ten million foreclosures facing all of us, and you will except if we have the latest construction – this building away from housing industries cast aside, we shall perhaps not comprehend the particular jobs production one to I do believe most people are hoping for.

Susan is great. We have to manage work. But we’ll n’t have an economic recovery if we cannot possess a casing healing. And now we can not care no more than helping a million some one. That’s however essential. We must assist four or five billion people to prevent all of them of going into foreclosures, because that only tear facing and you may functions facing things this government or somebody do to produce perform.

It should be even more serious than online personal loans Washington just one, a good walked right into among the many worst elements of you to definitely homes crisis now inside the Las vegas.

I will start by you, Susan Wachter. We just heard – and that i faith you’re able to pay attention to him – Jon Ralston inside the Las vegas, nevada outlining the challenge around. The guy told you what individuals require try a light at the bottom of one’s tunnel, some kind of assist.

It does surpass you to. The problem is exactly what Fannie and you may Freddie were doing try merely refinancing finance – 95 % of one’s funds he’s got refinanced was in the 105 %.