Will it be a personal plan on the dentist or something which is a genuine borrowing from the bank app?

Unfortunately, in advance of Christmas We install an infection/abscess doing an in the past molar/top!My personal dental practitioner really wants to extract the enamel, making me personally towards accessibility to with a hefty pit otherwise having an enhancement fitted!

With never ever utilized these types of fund plans prior to, I am being unsure of from what type of perception this should possess on my planned financial software!

Comments

The borrowed funds app – is this to invest in a home the very first time (aka swinging away from leasing) or perhaps is it a great remortgage?

Home loan app/Dental care finance?

In the course of time what kind of cash is both of these “loans” attending prices? How much cash have you been expecting to fork out month-to-month? Is your income assistance so it? Needless to say a good 0% deal is actually appealing but using some of the put tends to be a much better solution if for example the lingering income would be pushed having 2 finance at the same time.

I’m a forum Ambassador and that i hold the Forum Class towards Financial obligation Free Wannabe and you can Traditional style Money-saving forums. If you prefer one help on these chatrooms, manage let me know. Please be aware one Ambassadors aren’t moderators. One posts you place within the infraction of your Community forum Rules is always to become reported through the declaration button, otherwise of the emailing Every viewpoints was my own rather than the fresh new formal line of MoneySavingExpert.

About what I am aware, brand new habit gives the choice to sometimes Pay-as-you-go because you as a rule have making several appointments to get the enhancement fitted, or if you bequeath all round pricing by applying into loans alternative using another organization!

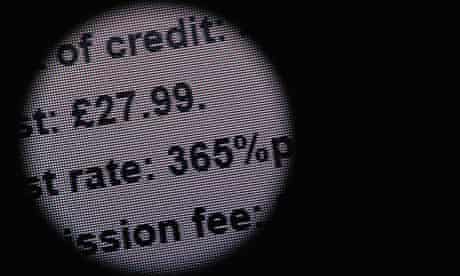

The new Monetary institution seems to supply the 0% price into a dozen month alternative and you will 9.9% for the two years or offered!

I’m a great FTB, regarding the behavior web site checklist this new implant costs, I might become possibly deciding on investing ?250 within 0% price to pay off the debt immediately following 12 months or closer to ?300 if bought out 2 yrs!

I’m want it may make significantly more feel in order to reduce the fresh application up to You will find removed the debt and replaced the newest a few of brand new coupons!

Its not really the home loan bring would-be faster. If that happens, one thing could have been overlooked regarding prior to the app going in.

There is an affordability calculator that each and every bank keeps and they the differ. I remember having a person who had a few grand on the handmade cards and you will a little financing. We had been seeking to increase the quantity he could rating and you may every lb counted. It turned out that have ?0 or just around ?step 1,150 on charge card made simply no improvement so you can exactly how much he may rating having Natwest. It could be a comparable with other lenders, however, most of the lender is variation and therefore are group problem.

Whether your money is actually ?20k a year up coming numerous your earnings goes getting used on only the principles. When you are on ?120k per year then you are probably keeps a great deal way more totally free bucks readily available.

To your an area notice, I lay a summary of the website a while straight back however, the principle continues to be an equivalent today since it ended up being. It has got a list of regarding the fifteen lenders. Using the same situation for all of loan providers (web browser combined app, exact same income, duties loans in Eva, put brand new financing wide variety ranged away from ?360k so you’re able to ?480k, thats as much as twenty-five% huge difference.

Communicate with a broker if this becomes nearer to enough time if you’re experiencing lending amounts. ?250 to the a loan that have money around ?20 30 days shouldn’t generate a huge difference, nevertheless you will dependent on your circumstances.