For this reason, it’s important to think about the possible affect the borrowing from the bank electricity prior to taking aside property guarantee mortgage

Should you decide to try to get a mortgage throughout the forseeable future, you can even consider other options, eg a consumer loan or credit cards.

Home collateral funds are a powerful way to availability the latest equity you really have accumulated of your house, however they also come which includes prospective downsides. Listed here are remedies for probably the most faq’s from the house equity mortgage downsides:

Concern step 1: Which are the dangers of taking out fully a property security financing? The most significant danger of taking right out a home equity loan was that you might reduce your property for people who default to the mortgage. Domestic security finance are protected by the domestic, meaning that the financial institution is foreclose in your family and you can sell to generally meet your debt if not build your payments.Question dos: Which are the other downsides off domestic guarantee finance? In addition to the risk of foreclosure, household security loans also have additional potential cons. These include:

Tip step 3: Definitely are able to afford the brand new month-to-month paymentsBefore you’re taking aside property guarantee financing, make sure you can afford the brand new monthly installments

- Higher interest rates than many other sorts of finance

- Closing costs

- Prepayment punishment

- Influence on your credit score

- Is almost certainly not tax-deductible

- Can reduce your borrowing from the bank strength for other sorts of funds

Matter step 3: How do i avoid the downsides of household equity money? There are activities to do to cease the drawbacks of home equity financing. They’re:

Tip step 3: Definitely are able to afford the latest month-to-month paymentsBefore you are taking out a house guarantee loan, definitely can afford this new monthly obligations

- Look around and you may examine rates of several loan providers

- Score an effective pre-acceptance for a financial loan beforehand household browse

- Make sure you are able to afford brand new monthly obligations

Concern 4: Any kind of selection in order to domestic guarantee fund? You will find some choice to help you home equity money, eg:

Concern 5: And this choice is right for my situation? A knowledgeable alternative to a home collateral loan for you will depend on individual factors. If you prefer a large amount of currency and you’ve got a good credit score, an unsecured loan otherwise an excellent HELOC ount of cash and you have less credit rating, a credit card otherwise a reverse mortgage tends to be a much better choice.Matter six: How can i discover more regarding the domestic guarantee financing? You can aquire more details about house security financing out of a form of provide, including:

It is important to weigh the huge benefits and you can disadvantages cautiously just before taking right out a home collateral loan. If you’re not yes if or not property collateral financing was effectively for you, its a good idea to correspond with an economic mentor.

Disclaimer: This information is having informational objectives simply and cannot feel sensed financial advice. Constantly consult a qualified economic elite before you make any monetary conclusion.

Home Security Loan Downsides

Domestic equity financing is a useful way to supply brand new security you accumulated of your property, but it is important to understand the prospective cons prior to you take out that loan. Here are four suggestions to remember:

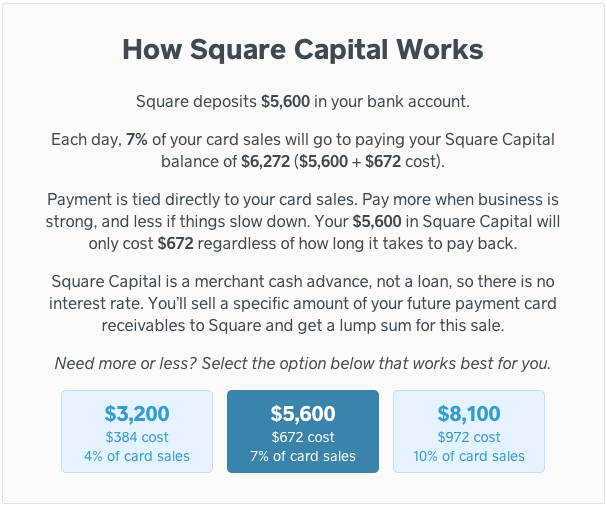

Suggestion step one: Comprehend the risksThe greatest likelihood of taking out fully a home guarantee mortgage is you can reduce your house if you standard on loan. Household security fund is actually secured by your family, and therefore the financial institution can be foreclose Arkansas payday loan companies on your house and you will sell it to meet up the debt otherwise create your repayments.Tip dos: Contrast rates of interest and feesHome equity finance routinely have high attention cost than many other style of loans, like signature loans otherwise handmade cards. It is essential to check around and you may compare interest rates of several loan providers before you take away a loan. It’s also wise to understand settlement costs and other fees regarding the financing. You will want to factor in the speed, the borrowed funds identity, and closing costs when figuring the monthly installments.Idea 4: Be aware of the tax implicationsThe appeal to the household collateral finance is only income tax-deductible if you use the borrowed funds buying otherwise replace your house. By using the loan with other aim, particularly debt consolidation otherwise family fixes, the interest will not be tax-allowable.Tip 5: Take into account the affect their borrowing scoreTaking out a home equity financing can be lower your credit rating. Simply because home equity fund are considered are a beneficial secure loans, that is riskier to own lenders than simply unsecured debts, including unsecured loans or credit cards.