Machinery, Equipment, Materials, and Services Used in Production

In these cases, a company can move raw materials directly to finished goods. However, if there’s a considerable length of time spent in production, it’s advised to consider these as WIP inventory. Code 3385 applies to employers engaged in manufacturing watches, watch movements and clocks. Materials such as ferrous and non-ferrous alloys, fasteners, cases, gems, and watchbands are received from others and used to make watches. The manufacturing process involves casting the metals, punching, blanking, turning, grinding, plating, and assembling the watches and clocks using hand tools or small machines. The items are inspected, tested and packed for shipment to the customer.

What is the finished goods inventory formula?

Maintaining the right level of finished goods ensures smoother operations and better financial performance across the company’s supply chain. But, as a rule, you want to minimize finished goods inventory to keep storage costs down. The point here is getting familiar enough with your finished goods inventory level that you can draw actually useful conclusions from it. And this $70,000 worth of finished goods inventory will, of course, be the next accounting period’s beginning finished goods inventory.

Stabilize Supply Chain Operations

Running out of stock on popular items can damage your brand image and lead to frustrated customers. Maintaining a buffer of finished goods inventory helps mitigate the risk of stockouts, ensuring business continuity and customer satisfaction. This formula shows how much inventory you have left at the end of the accounting period after you have accounted for your production and sales activities. The easiest way to calculate finished goods inventory is to use the finished goods inventory formula.

How to calculate finished goods inventory

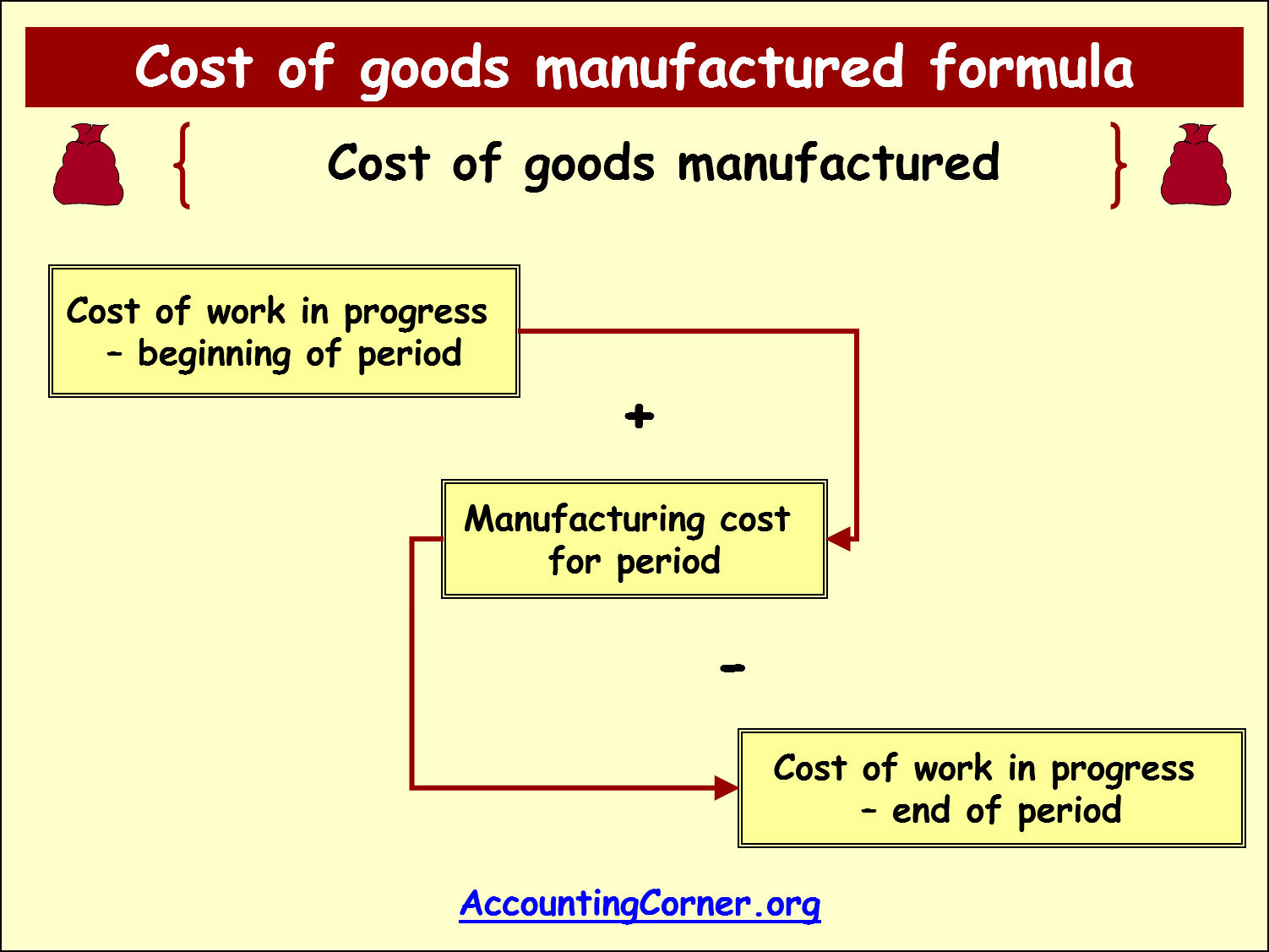

In this comprehensive blog, we’ll dive deep into the intricacies of the finished goods inventory formula, revealing the secrets behind calculating your stock like a pro. Finished goods inventory is the total on-hand stock of products that have completed the production process and are ready for sale. The value of these products must be reported in your financial records. Note that total manufacturing costs is equal to direct labor, direct materials, and overhead costs. The differences between finished goods and the two other types of inventory, raw materials and work in progress (or work in process), are their stage of production and the value they hold to the company. The bulk of manufacturing operations involves taking raw materials and turning them into finished goods.

Concrete Construction – NOC – All Operations to Completion

Intensive audits, tests, and reworking occurred at every level—one mistake, one faulty component, could cost the company millions in lost revenue.

- The actual remuneration of golf caddies shall be included in determining the premium for the employer.

- The point here is getting familiar enough with your finished goods inventory level that you can draw actually useful conclusions from it.

- Read more about dynamic slotting, distributed order management and virtual warehousing.

- Extracting raw materials from natural resources involves mining, drilling, harvesting, or other methods of extraction, activities that are likely to be legislated, or require licenses and approvals.

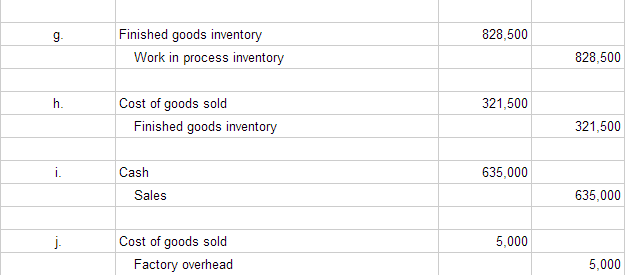

The products in a manufacturer’s inventory that are completed and are awaiting to be sold. You might view this account as containing the cost of the products in the finished goods warehouse. A manufacturer must disclose in its financial statements the amount of finished goods, work-in-process, and raw materials.

And you simply must have dedicated areas for clearance or discounted items as well as seasonal, time-sensitive products. Once products have passed assembly and inspection, they are classified as finished goods, meaning they are now complete and ready to be sold or distributed to customers. For example, in furniture production, the cut and shaped wood is polished, upholstered, or painted, and final adjustments are made to ensure the product is ready for the consumer. When you sell your finished goods, remove their cost from the finished goods inventory account. Inventory is considered a current asset because the company expects to sell the goods and convert them to cash within a year or the normal operating cycle.

All joints are then fluxed and soldered, and putty is pushed into all open spaces between the glass and the cames. Finished goods inventory refers to the stock of completed products that manufacturers have produced and are ready to be sold to customers, retailers, or other businesses. This type of inventory is the final stage of the manufacturing process, where the products are ready for wholesale distribution and wholesale sales. Code 5610 applies to employers engaged in removing construction or erection debris provided they are not engaged in construction or erection operations. Accurate inventory data is critical to avoid overstocking or stockouts, which can lead to lost sales or excess carrying costs. Manual data entry errors and lack of real-time tracking often cause these issues.

For example, if a factory produces furniture, the wood is the raw material, labor is required for assembly, and manufacturing costs might include electricity and machine maintenance. Raw materials finished goods accounting inventory is all the ingredients or base component parts that will be used in the production process. They’re considered raw materials inventory until they’re combined with human labor.